Shocking, yet true - Internet-based task is not the protect of the young " electronic citizen" generation alone. A 2008 survey states that Generation X (those birthed between 1965 as well as 1976) uses Electronic banking significantly greater than any other demographic sector, with two thirds of Web customers in this age banking online.

Gen X users have also proclaimed their preference for applications such as Facebook, to share, link as well as belong to a bigger neighborhood.

This is some irony in this, because electronic banking, as we know it today, uses minimal interactivity. Unlike in a branch, where the comfort of two method communication promotes the consummation of a variety of purchases, the one means street of e-banking has actually just managed to make it possible for the extra routine jobs, such as balance query or funds transfer.

It's not difficult to put two and two together. A clear possibility exists for banks that can change today's passive Electronic banking offering right into one that gives a much more extensive and interactive customer experience.

It is for that reason vital that banks transform their on-line offering, such that it matches the new expectations of clients. Moreover, Internet banking have to journey to prominent on the internet client hangouts, as opposed to wait for clients ahead to it.

There are clear indications that the change towards a "next generation" electronic banking atmosphere has actually already been instated. It is just a issue of time prior to these patterns come to be the standard.

Leveraging of Social Networks

Onward thinking banks are leveraging existing socials media on external websites to raise their visibility amongst interested groups. They are likewise releasing social software program innovation by themselves websites to involve the very same areas in 2 method conversations. Therefore, their Electronic banking has actually thought a extra prevalent identity - customers are involving with the bank, together with its services and products also when they're not really negotiating online.

Increased visibility apart, financial institutions can acquire remarkable client understanding from such unstructured, casual communications. As an example, a conversation on the uncertain monetary future amongst a team of 18 to 25 years of age could be a signal to banks to supply long-term investment products to a section that was formerly not considered a target. Going one action better, a favorable buzz around a freshly launched service can develop important referral advertising for business.

Teaming up with Web 2.0

The collective facet of Web 2.0 applications has actually made it possible for banks to attract clients inside their layer more than ever before. Standard approaches such as focus group discussions or marketing research experience the drawbacks of high cost, minimal scope and possibility to present bias. Comments types simply serve as a post-mortem. In contrast, Web 2.0 has the ability to carry a huge audience along right from the start, as well as continue to do so perpetually. Thus, an interested neighborhood of leads as well as customers participate in co-creating services and products which can fulfil their assumptions.

The pervasiveness of Internet 2.0 makes it possible for shipment of e-banking throughout several on-line places and online devices such as Yahoo!Widgets, Windows Live or the apple iphone. This means next generation electronic banking clients will take pleasure in intense accessibility as well as convenience

A New York based firm of experts located that 15% of the 70 banks tracked by them had embraced Internet 2.0, a number of them having actually done so within the last 12 months.

Standard Chartered Teller connect with their associates via Facebook and utilize the system to share understanding, make clear concerns as well as take part in discussions on continuous firm tasks.

Bank of America, Wachovia Financial Institution as well as Commonwealth Lending institution have actually developed a existence within multimedias to create awareness as well as keep up a discussion with interested neighborhoods. They have actually utilized a variety of techniques, varying from creating YouTube neighborhoods to launching campaigns on Current television, a channel in which visitors establish content.

Personalisation of Electronic Banking

Vanilla e-banking divides clients right into huge, heterogeneous teams - typically, company, retail or SME, with one type of Electronic banking web page for each and every. That's in sharp contradiction to exactly how banking organisations want to view their clientele. Financial institutions are moving towards customer-specificity, virtually viewing each customer as a " section of one", across other channels, and electronic banking is readied to do the same. For instance, a particular home page for home mortgage clients and also one more for exclusive financial customers can well be a opportunity in future.

Remarkably, National Bank of Kuwait had the foresight to do this numerous years ago - they allowed customers to establish which items they would view and also access, as well as were compensated with a significant boost in on-line purchases.

Money Display from Yes Bank allows consumers to pick their landing web page - for example, they can set "all purchases", " total assets" or " profile" as their default view. Various other functions include the capability to categorise transactions according to clients' ease and also the printing of personalized reports.

Empowerment Online

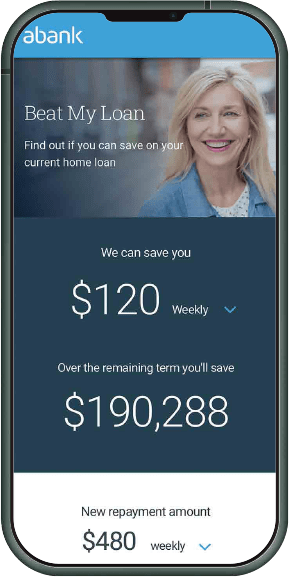

Beyond doubt, Electronic banking has actually produced a much more informed, encouraged course of consumers. This is readied to reach the following level once customers are allowed to proactively take part in many more transaction-related processes. The Net has currently made it possible for consumers to compare item car loan offerings, replicate monetary situations and design custom retirement profiles. Moving forward, they would be able to consummate relevant transactions - which indicates, after contrasting rates of interest, they could stem a finance online, and once safeguarded, they can start to settle it online also.

Portalisation

The emergence of Internet 2.0 innovation combined with financial institutions' wish to customise their e-banking to the highest degree is likely to lead to "portalisation" of Internet banking. The suggestion of financial consumers being able to create their own rooms online, loaded with all that pertains to them, is not that improbable. Clients can personalise their Electronic banking web page to mirror the settings retail banking software solutions of multiple accounts across different financial institutions; they might include their charge card info, subscribe to their preferred monetary news, combine their physical properties setting, share their experiences with a team and also do more - all from one " location".

Money Screen enables clients to add several "accounts" (from a selection of 9,000) to their page. Accounts could be financial savings or lending accounts with significant Indian financial institutions, or those with energies providers, credit card companies, brokerage firm companies and also also constant flyer programs. Users can personalize their web pages as defined earlier.

As banks look for to establish their Electronic banking vision for the future, in parallel, they will certainly also need to attend to the essential issues of safety and "due protection". While it is every marketing expert's dream to have consumers work as ambassadors, appropriate preventative measure needs to be taken to avoid the spreading of malicious or spurious attention. Consequently, before an person is permitted to participate in a networking online forum, she or he should have developed a beneficial track record with the bank. The private must be a acknowledged consumer of the financial institution, having actually made use of a minimal variety of products over a reasonable length of time. Qualitative info concerning the individual's communication with the bank's support team (for example frequency and also sort of phone calls made to their phone call centre, result of such interaction and so forth) might be vital in profiling the " ideal" kind of client that can be hired as a possible advocate.

Joint Internet 2.0 applications might necessitate opening up banks' internet sites to outside technology as well as info exchange with 3rd party websites, raising the spectre of data and also framework safety. A robust device of checks and equilibriums need to be built to make certain that the 3rd party websites are safe, suitably licensed and also present no danger to the house financial institutions' sites. Furthermore, prior to a 3rd party widget is permitted to be caused to a site, it must have gone through stringent safety and security control.

Due persistance should be worked out before allowing users to place a link to an additional website to guard against the possibility of unintended download of malicious software, which could, in the most awful situation, also lead to phishing originating from the banks' websites.

It is just as important for a bank to guard its consumers against intrusion of personal privacy, information theft or misuse. The idea of portalisation envisages deploying modern technology to bring info from other financial institutions' or monetary service providers' web sites right into the home financial institution's site. The house financial institution need to make certain that its consumers' personal or purchase related details, which might be shown to the other suppliers, is not susceptible to leak or straight-out abuse.

Banks will do well to partner with an Electronic banking remedy carrier which has not just the proficiency to equate their vision right into a reducing side e-banking experience for the customer, but likewise the insight to define limits for safety and security. With protection problems appropriately addressed, next generation Internet banking teems with amazing possibilities. Financial institutions that seize the opportunity might discover that Electronic banking can come to be a method of differentiating themselves from rivals, rather than a plain price reducing device. Clearly, supplying a more powerful and interactive e-banking experience, is the means onward.